For decades the sports business ran on a three-tiered system: clubs produced the product, broadcasters packaged it and ticketing/merchandise partners handled the money. Over the past few years that neat model has been under pressure — and today it’s fast becoming obsolete. Teams around the world are building their own distribution and commerce channels, moving from broadcasting and third-party ticketing toward a direct-to-fan (D2F) model that treats fans as customers to be won, known and monetized across an always-on relationship. The drivers are simple: streaming is king, data is invaluable, and engaged fans spend far more.

Why now? Two structural shifts

First: attention has migrated to streaming. In mid-2025, Nielsen reported that streaming accounted for almost 45% of U.S. TV viewing in May — the first time streaming outpaced broadcast and cable combined. That tidal shift changes the bargaining power of rights holders: live sports still draw audiences, but the pipes that carry those audiences are now many and digital — a perfect environment for rights owners to experiment with direct distribution.

Second: clubs and leagues are waking up to the economics of engagement. Multiple industry studies show that highly engaged fans spend many times more than casual viewers — buying tickets, subscriptions, merch and premium experiences across seasons. This makes the ability to own the fan relationship (and the first-party data that comes with it) a strategic priority. Consultancy research and major surveys now explicitly recommend building direct fan platforms to drive lifetime value.

Real examples: not just theory

Some of the clearest signals are already visible.

• Formula 1’s move to consolidate and reshape distribution is a bellwether. In a major rights shift announced in 2025, F1 agreed to distribute its U.S. coverage exclusively through Apple’s streaming ecosystem starting in 2026 — a move that shows rights holders are willing to reconfigure long-standing broadcast relationships in favor of streaming partners who can deliver integrated, direct experiences.

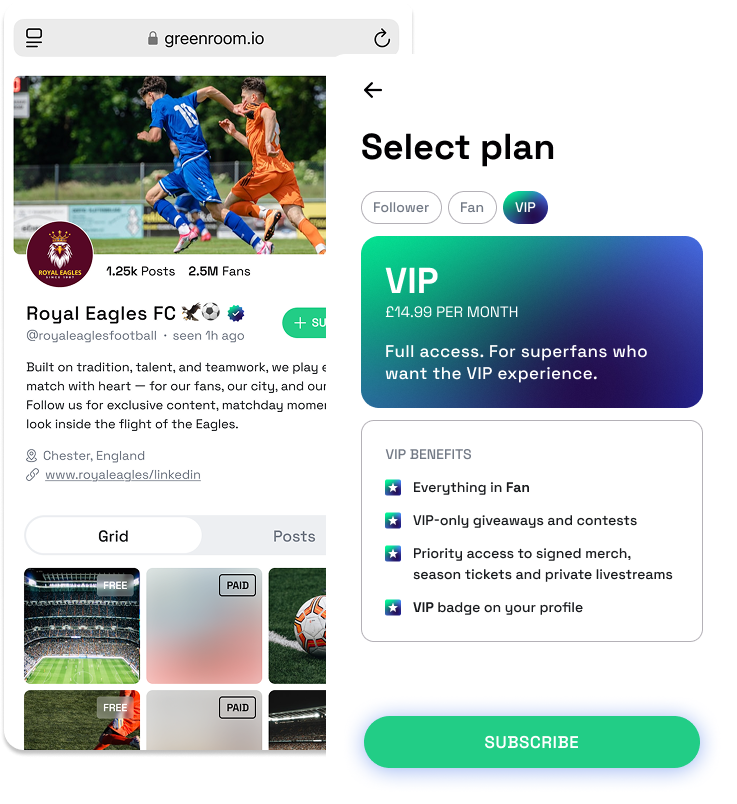

• Clubs are already operating their own streaming and membership ecosystems. Real Madrid runs RM Play and a sophisticated club app and membership program that bundles video, content and commerce; Manchester United and other clubs similarly use paid membership tiers, club apps and their own video channels (MUTV, club apps) to give members exclusive access and priority ticketing. That means fans increasingly subscribe to teams, not just leagues or broadcasters.

• Commerce and content are converging. Fanatics — until recently best known as a global merch platform — has expanded into livestreaming commerce and struck integrations with sports streamers like DAZN to sell merchandise directly inside streaming experiences. These partnerships show how a D2F play blends content, commerce and community into a single funnel.

New revenue levers: beyond tickets and TV money

Direct-to-fan isn’t only about streaming live matches. It unlocks a stack of revenue and engagement levers:

• Subscriptions and micro-payments — team channels can offer tiered access (highlights, full matches, behind-the-scenes), turning casual viewers into recurring customers.

• Exclusive content and experiences — virtual meet-and-greets, training ground feeds, player mic-ups, or season-only documentaries.

• Commerce inside content — buy the shirt you see in the video right there, or bid on memorabilia in a live auction embedded in a stream.

• Digital collectibles, fan tokens and new ownership models — Socios-style fan tokens and community funding experiments let supporters buy stakes in voting, rewards and experiences, tightening the emotional (and financial) tie.

Risks and friction points

D2F is attractive, but it’s not frictionless. Building first-party platforms requires investment in technology, analytics and rights management. Teams that go direct must also manage distribution partnerships carefully — Apple, Amazon and other big streamers can be both partner and competitor. There’s also the fan experience risk: fragmentation across club apps and league services can frustrate fans who don’t want to subscribe to a dozen different platforms. Finally, regulatory and rights-payment concerns (how revenue gets shared with leagues and broadcast partners) are not trivial.

What success looks like

The clubs and leagues that win will do three things well: collect and act on first-party data; unify commerce, content and community; and make the experience frictionless for fans. That means a single identity (one membership/login), personalized communications, integrated ticketing and offers tied to viewing behavior, and premium content that rewards paying fans without alienating the wider audience.

Our Takeaway

A future of hybrid distributionThe direction is clear: more teams and sports properties will adopt direct-to-fan strategies, but successful rollouts will be hybrid. Rights owners will combine their own channels with distribution deals (sometimes exclusive, sometimes layered) to maximize reach and revenue. The race isn’t just to stream matches — it’s to own the long-term relationship that turns viewership into loyalty and loyalty into sustainable revenue. As streaming becomes the dominant way people watch and as fan monetization strategies get more sophisticated, expect the D2F playbook to move from pilot programs to boardroom strategy.